How ABC Apple Pie Option Trades Over 45 Years Of Trading Wisdom

Produces Auto-Pilot Equity Growth Specializing In Revenue > Greater Than 401Ks and IRAs For Our Exclusive Community

Achieving Higher Returns Over 8% A Month In Your Own Brokerage Account With No Effort And No Work

Achieving Thousands Of Dollars In Resources For Caregiving Families Across America

“Supporting Families With Humane and Sustaining Financial Resources To Be Caregivers For What Matters Most In Life”

Apply Now To Be Accepted In

The Exclusive ABC

Auto-Pilot Trading

Community As A Member

And Give Up Working A Job

Click The Gold Button to Book Your 1 on 1 Call With Our Experts And Get Started In Less Than 120 seconds:

“Join Our Auto-Pilot Trading Community : Exclusively Giving Families Cash Flow Earnings

Without Stress or Time or Any Work”..

—————————————————-

View Our Clients’ Experiences –

Click The Video:

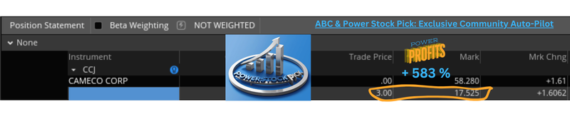

Cameco stock options Bought at $3.00 and now is $17.52

Profitable earnings of +583%

– How Donavan Transformed A Broken Stock Market Strategy In ONE Shift –

Wondering If Our Expert Money Solid Profit Strategy Really Works?

Hear Our Valued Client Testimonials

The OLD WAY is the “money rollercoaster” of Day Trading

that causes enormous daily stress.

Unlock The New Way To Make Profits Without Staring At A Screen

Professional Options Trading Systems

That Put Your Money To Work For Your Family

To Grow Your Portfolio With

Exclusive Auto-Pilot Trading

Auto-Pilot Trading Growth Equity APTGE

You Don’t Stare At A Screen And You Don’t Need To Daily Follow The News –

To Strongly Profit With Our Over 45 Years Experience.

If you are a day-trader..

And you want to significantly profit – without chasing the daily news..

We have a low key celebrated trading strategy that rises above the news..

Because we accept only families that are thankful for our different style of trading..

Apply by clicking the Yellow button below and see if you have the values to be accepted in our

Exclusive Auto-Pilot Trading

Community

Q: With the stress of Day Trading, isn’t it far more of an advantage to have

Exclusive Auto-Pilot Trading

without the high pressure cooker of micro movements driven by the news and the pips?

Billionaire Charles Schwab

personally recruited our expert mentor

Donavan Shapray

to head Schwab’s national Options trading

as one of the most recognized pro Options specialists in the world.

*Daymond John of the TV show “Shark Tank” with Donavan*

First, let’s get clear on what this is NOT

There’s Just One Catch:

This Is Not A Get Rich Quick Strategy.

Experience And Values Put To Work For Your Family

– Why Do Billionaires Go To Work Everyday

If Enough Money Was The Reason

That Motivates Them? –

TRUTH:

“Day Trading” regularly

burns out

traders –

because it’s frequent losses are

costly

outrageously inefficient,

and horribly frustrating,

“Day Traders – They over-leverage, make large losses and

then burn out trying to chase recovery.”

leading to chronic disbelief and

toxic cynicism

that ruins trader’s

powers of judgment

chasing the news.

We Help Executive C-Suite Business Owners

Become Highly Successful Former Day Traders

With

Exclusive Auto-Pilot Trading

.

Imagine

The New You

That Can Actually Transform

Your Previous Finance Values

Profits That Will Gain Or ReGain You The Respect of Your Family.

Like Our C-Suite Business Clients

Including Colonel John Wintels US Army:

WATAUGA, TENNESSEE

“THIS IS HOW WEALTH IS CREATED QUICKLY. I’M TALKING LIQUID WEALTH”

Warren Buffett and Bill Gates

Don’t Day Trade

– “Just Quit Day Trading

And Get Free From The Routine Of

The Daily News Rollercoaster”

Read Donavan Shapray’s feature article written for our following of

stock market “anti-adrenaline C-Suite business professionals” on LinkedIn

about Warren Buffett, Bill Gates, Charlie Munger and the quiet revolt against

the popular wide-spread media-promoted practice of Day Trading.

https://www.linkedin.com/pulse/warren-buffett-doesnt-day-trade-i-used-think-you-cant-donavan-shapray

“We help professional “growth forward” business C-Suite execs to truly understand what Warren Buffett’s values are – to get free from Day Trading –

Apply Now to Join Our Options

Exclusive Auto-Pilot Trading“

*See Our Disclaimer As Educators

(Not Highlight Reel)

Apply Now To Schedule Your 1 on 1 Exclusive

ABC Apple Pie Options Trades

Auto-Pilot Trading

Call To Be Accepted As A Community Member

NOTE: If Your Trading Habits Are Stressful, You May Be Able To Learn The Inside Secrets to Non-Mainstream Option Trading With Our Best Selling Book.

Our ABC community member, a seasoned decades long professional Wall Street trader, went from frequently breaking even, sometimes winning, watching the stock market daily and stressing, and often losing money, to learning how to position and manage being in a much more stable trading position that reaps regular profits without the stresses of the trading style that is preached by the major financial press.

Warning: There are classroom group “Trading Academies” that loudly radio advertise that Wall Street doesn’t lose (just not true), that they give “Insider Booklets” suggesting that learning basic terminology and beginner trading concepts like Stop Loss will make you the “insider”, and that next year the announcer would pay for his Christmas presents in cash – and nothing could be further from the truth. Most traders lose money because they do the trades that everyone else does.

Warning: There are classroom group “Trading Academies” that loudly radio advertise that Wall Street doesn’t lose (just not true), that they give “Insider Booklets” suggesting that learning basic terminology and beginner trading concepts like Stop Loss will make you the “insider”, and that next year the announcer would pay for his Christmas presents in cash – and nothing could be further from the truth. Most traders lose money because they do the trades that everyone else does.

Apply to join the quiet revolt of the Anti-Day Trading Movement now.

Anxiety Free Option Investing:

Using Covered Spreads As A Hedge Vs. Downside Risk

Paperback Published August 1, 2008 $69.95

Note: If you are a struggling young student and you are able to pass our standards, we do Award limited Scholarships to special families.

As Seen Advertised In The WSJ and Facebook Ads

As Seen Advertised In The WSJ and Facebook Ads

We Believe Quite Differently About Trading Options:

If you are the kind of person that worries about the daily news headlines – the way we and Warren Buffett trade, is not like that perspective.

If you’re the kind of trader that has years or decades of experience trading with complex strategies, and you’re a jealous insecure type who thinks they know almost everything – we will not be able to work with you because what we teach is not taught by many traders, because it doesn’t generate large commissions like Day Trading does.

As you are the kind of person that likes to have maximum control over every aspect of your trading life – and is not happy being on the roller-coaster of daily market news – then you may be able to join our group of

Exclusive ABC

Auto-Pilot Trading

Community Members

that are authentic students of what Warren Buffett understands – following the news is not the path to profit – what values we hold are not like the conventional way of trading you hear so much about by “pundits”.

The simplest way to benefit from skilled Options traders is to be together with the best.

We cannot accept many traders as

Exclusive ABC Community Members

– because they have trading habits that don’t work with our methods.

The mainstream financial media such as MSNBC, CNN, CNBC, Suze Orman, Bloomberg, and the Wall Street Journal have been talking-down to investors as if they’re too stupid to use the power of Options.

And most of the financial media and experts have lumped all Options into the same group.

Yes, some Options strategies are more advanced and the truth that they don’t want you to know is that many Options strategies are quite learnable for even a 12 year child as shown by 12 year old Option traders that have been interviewed about their success in the stock Options market.

With the looming costs of about $90,000 a year for nursing home care for parents, and the enormous pressures of student loans, investors are sick and tired of being told that they have to listen to personal finance “experts” that disrespect their intelligence and betray their freedom of choice.

We believe that the time has come for investors to fight back against the financial press.

The vision of Options Expert Donavan Shapray is to reach out to a select class of disciplined traders worldwide and empower the average ordinary investor so that they will no longer be intimidated and belittled into feeling that only the elites can use the power of Options to make their lives freer financially.

Donavan comes from a wonderful well-known family with Mid-Century Modern Design distinctions that you can read about here:

https://midcenturymodernstyles.com/about/

Apply to see if you are qualified to become an ABC

Exclusive ABC Community Member

:

The Truth About Options Trading

Get Your Time Back With Auto-Trading ABC Apple Pie Options.

Let’s face it—it’s difficult to be an investor in the 2020’s.

You’re bombarded with opinions and advice on all sides about what stocks to own… and too often it’s based on faulty data, shaky logic, or bad guesses about the future.

Looking forward to you being in our

Exclusive Auto-Pilot Trading

Community Group if you are accepted.

Donavan Shapray Options Expert

CEO

www.abcapplepieoptiontrades.com

Not All Traders Can Be ABC Apple Pie Options Traders

Apply Now To Discover If You Are Able to Be Accepted Into Our

Exclusive ABC Community Member Group.

Billionaire Charles Schwab personally recruited Donavan to head his Option trading.

Donavan Shapray started out playing college football. He has a heart felt passion for seeing his teammates succeed.

When Donavan started trading in the stock market, he struggled with the traditional problems of buying stock and just hoping it goes up like most investors are told.

He sought out a better way through the creative forms of Options trading after sorting through the many strategies that are just plain frustrating like buying covered calls and strategies that involve Margin – which he thinks is even more frustrating.

He then applied this sports strategic sense to picking competitive winning stocks and pairing those picks with the creative and sensible research backed Options strategies. Donavan finds great enjoyment from picking winners in sports and the Stock Options Market.

Applying his team picking skills, Donavan is the newly announced NFL Fantasy Football league Trophy Champ and for the last 5 years in a row.

This parallels his stock picking skills.

Steve Atwater, Defensive star of the Denver Broncos NFL football team, and two time Superbowl champion, is a mentored personal student of Donavan’s Option trading strategies.

https://twitter.com/SteveAtwater27

ABC is Always Be Covered, and that’s the happiest place to be in the Stock Options Market, rather than being “naked” as it’s referred to in the trader’s lingo.

Donavan has designed and build futuristic homes and he feels that there is a beauty in architectural geometry that appeals to his sense of practical construction and bringing ordered sense in how to trade Options.

He cares about solid homes and the life that can provide for families, just like he cares about solid Options trading strategies.

He applied the many principles in the lessons he learned in the trial and error of home design and construction, to the Options market as he sought out safe foundation strategies that are easy to teach and understand and enable his students to live happier and more prosperous lives that support their loved ones.

https://midcenturymodernstyles.com/about/

Think or Swim had a long-standing relationship as well as being a giant fan of Donavan.

Many of Donavan’s subscribers have spread the clear word of his best-selling Option Trading book “Anxiety Free Option Investing”, which was advertised through and approved by the Wall Street Journal because Donavan’s way of teaching Options is super clear and easy to understand for the beginner trader, and has super valuable nuances for the advanced trader.

Our client Vince K. Grieco, from Manhattan and NJ, past managing director KMI Kountmein, one of the world’s top management consulting firms, is wonderfully pleased with our market methods.

Apply now to be accepted in our exclusive Auto-Trading Community Group with options so that you don’t have to worry about the market news, or the ups and downs of the stock prices.

Researching and analyzing corporate dynamics is satisfying work – and when you find a resource that has the experience to comprehend today’s market fluctuations, you grab it.

But if you’re not grateful for decades of experience, you’re not ready to work with these kinds of results.

Stick to your mutual funds.

*Daymond John of the TV show “Shark Tank” with Donavan*

Apply Now To See If You Are Qualified To Be An ABC

Exclusive Auto-Pilot Trading

Community Member

and ask The Expert, any questions you have about trading or the market.

How do you Buy Low to Sell High in either Bullish or Bearish markets…

AND do it PROFITABLY in ANY economy?

Apply Now To See If You Are Qualified To Be An ABC

Exclusive Auto-Pilot Trading

Community Member

If You Are Accepted, We Will Invite You To Schedule a Valuable Strategy Options Trading Analysis Session To Get A Step By step-by-step framework And Put Our Heads Together To See If We Can Solve Your Time And Trading Problems.

When you decide that you want to Auto-Trade Options the ABC Apple Pie Easy way that Donavan Shapray pioneered, you’re going to get a new chapter in your life with the Options Market that will change your life.

You will benefit from the “strategic profit” best secrets of SuperTraders.

You will enjoy much less stress.

We will show you the exact catalysts for massive change in the way we trade the Options Market.

Most people rarely achieve this degree of knowledge about Options Trading.

Buy into yourself and sign-up to Apply for acceptance in our Options Trading

Exclusive Auto-Pilot Trading

Community Group

to see if you qualify to make this way of trading work for you now today.

We Are

Market-Ready

& Responsive

The President has profound global influence on the money markets.

Having perceptive advantage in investment strategy will reward those that invest in their education.

Donavan The Stock Savant’s subscribers are not cowering from drop after drop in the Dow Jones.

Q. Why should I invest in Call Calendar Spreads vs buying the stock itself?

A. The stock purchase requires much larger investment and much greater risk and much lower ROI.

Before you buy or sell options, you need a strategy. Understanding how options work in your portfolio will help you choose an options strategy.

Choose the Right Strategy

A benefit of options is the flexibility they offer. They can complement portfolios in many different ways. It’s worth taking the time to identify a goal that suits you and your financial plan. Once you’ve chosen a goal, you’ll have narrowed the range of strategies to use. As with any type of investment, only some of the strategies will be appropriate for your objective.

A particular strategy is successful only if it helps you meet your investment goals. For example, if you hope to increase the income you receive from your stocks, you’ll choose a different strategy from an investor who wants to lock in a purchase price for a stock they’d like to own.

Start Simple

Some options strategies, such as writing covered calls, are relatively simple to understand and execute. Complicated strategies such as spreads and collars require two or more opening transactions. Investors often use these strategies to limit the risk associated with options, but they may also limit potential return. When you limit risk, there is usually a trade-off.

Simple options strategies are usually the way to begin investing with options. By mastering simple strategies, you’ll prepare yourself for advanced options trading. In general, more complicated options strategies are appropriate only for experienced investors.

Stay Focused

Once you’ve decided on an appropriate options strategy, it’s important to stay focused. That might seem obvious, but the fast pace of the options market and the complicated nature of certain transactions make it difficult for some inexperienced investors to stick to their plan.

If it seems the market or underlying security isn’t moving in the predicted direction, it’s possible to minimize your losses by exiting early. However, it’s also possible to miss a future beneficial change in direction. That’s why many experts recommend that you designate an exit strategy or cut-off point in advance, and hold firm. For example, if you plan to sell a covered call, you might decide that if the option moves 20% in-the-money before expiration, the loss you’d face if the option were exercised and assigned to you is unacceptable. If it moves only 10% in-the-money, you’d be confident that there remains enough chance of it moving out-of-the-money to make it worth the potential loss.

This answers the questions of most experienced option investors

If you are Bullish?

These are Bullish Strategies!

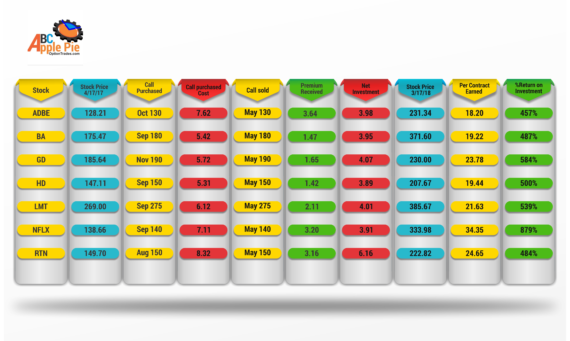

We Have

An Amazing

Track Record of Stock Picks

With The Stock Savant’s identification of year after year of enormous corporate movers, subscribers are able to learn what makes stocks move in reality vs what the media says.

We Offer

Free subscriber updates

& Support

Stock Picking is about supporting our subscribers with education combined with market timing. When you have questions, we have the answers that make sense in the context of what information you seek to make the very best of your investment dollars at work. Work ethic is what makes corporate management out-compete their rivals, and The Stock Savant is passionate about support and illuminating the mis-understood areas of corporate finance.

Like what we offer?

Start with our basic Subscription now or check out the others to choose what you need.

Our services

Grow your portfolio with the finest Stock Picks

Exclusive Auto-Pilot Trading

It frees Your Time And Is Stress-Reducing

Your portfolio is like an engine and Stock Picks are like the fuel for your growth

We mentor you with our yearly Platinum Plus Subscription:

Mentoring Beginner:

Mentoring Intermediate:

Options Easy Mentoring Sessions

Industries Analyzed

Happy Customer Dollars

Antony Moore

Bryan Thompson

Ann Smith

Alice Brown

Our expertise

Based on experience

The Power Stock Pick team used 13 years of experience to build the most advanced Stock Market strategy ever built. The Stock Market strategies were created with all those remarks and wishes our clients ever expressed. Every single feature or option you will ever need can be found within our strategies.

Gainers and the breakthrough innovation of truly overcoming the worry of following the direction of the news of the market

Did you find anything you like?

Check out our Personal One-On-One Mentoring plans for portfolio power-up

Check out our Personal One-On-One Mentoring plans for portfolio power-up

ABCApplePieOptionTrades.com and PowerStockPick.com have everything to get you covered in learning and making money with Options. Take a look at the stock market money-making picks available for you. The list of picks covers the most popular sectors including Defense, Business, Fashion and Retail.

Disclosure Statement:

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options

Disclaimer:

Options trading involves substantial risk and is not suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade options, carefully consider your investment objectives, level of experience, and risk tolerance.

You could lose some or all of your initial investment. Do not invest money that you cannot afford to lose. Consult with a qualified financial advisor to determine if options trading is appropriate for you.

Past performance is not indicative of future results. Simulated or hypothetical performance results have limitations and do not represent actual trading. Hypothetical trading does not involve financial risk, and actual trading results may differ significantly.

No representation is made that any person will or is likely to achieve profits or losses similar to those shown. Market factors, such as liquidity and the ability to withstand losses, can adversely affect actual trading results.

This disclaimer is for informational purposes only and does not constitute investment advice. Seek advice from a qualified professional before making any investment decisions.

Trading stock options carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in options you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with options trading and seek advice from an independent financial advisor if you have any doubts.

The purchase, sale or advice regarding options can only be performed by persons registered with (unless exempt from registration) (i) the CFTC (futures commission merchants, introducing brokers, commodity trading advisors, commodity pool operators, dealers, and licensed associated persons of such entities), and/or (ii) the SEC (broker-dealers and/or investment advisers and their licensed associated persons), and (iii) a state regulator (each, an “Intermediary”).

Neither we, nor our affiliates or associated persons involved in the production and maintenance of our products and services or this website, is an Intermediary. All purchasers of products and services referenced on this website are encouraged to consult with an investment professional regarding any trading strategy or a particular trade. We make no representation that you will or are likely to achieve profits or losses similar to those discussed on this website. The past performance of any trading system or methodology is not necessarily indicative of future results.

We emphasize that no information set forth on this website is an invitation to trade any specific investments.

Trading requires risking money in pursuit of future gain. That is your decision. Do not risk any money you cannot afford to lose. This website does not take into account your own individual financial and personal circumstances. It is intended for educational purposes only and NOT as individual investment advice. Do not act on this information without advice from your investment professional, who you should expect to determine what is suitable for your particular needs and circumstances. Failure to seek detailed professional, personally-tailored advice prior to making any investment could result in actions contrary to your best interests and loss of capital.

*CFTC RULE 4.41(b)(1)/NFA RULE 2-29 – SIMULATED OR HYPOTHETICAL PERFORMANCE RESULTS HAVE CERTAIN INHERENT LIMITATIONS. UNLIKE THE RESULTS SHOWN IN AN ACTUAL PERFORMANCE RECORD, THESE RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, BECAUSE THESE TRADES HAVE NOT ACTUALLY BEEN EXECUTED, THESE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY.

SIMULATED OR HYPOTHETICAL TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE BEING SHOWN.

NO REPRESENTATION IS BEING MADE THAT ANY PERSON WILL OR IS LIKELY TO ACHIEVE PROFITS OR LOSSES SIMILAR TO THOSE SHOWN. IN FACT, THERE ARE FREQUENTLY SHARP DIFFERENCES BETWEEN HYPOTHETICAL PERFORMANCE RESULTS AND THE ACTUAL RESULTS SUBSEQUENTLY ACHIEVED BY ANY PARTICULAR TRADING PROGRAM.

IN ADDITION, HYPOTHETICAL TRADING DOES NOT INVOLVE FINANCIAL RISK, AND NO HYPOTHETICAL TRADING RECORD CAN COMPLETELY ACCOUNT FOR THE IMPACT OF FINANCIAL RISK IN ACTUAL TRADING. FOR EXAMPLE, THE ABILITY TO WITHSTAND LOSSES OR TO ADHERE TO A PARTICULAR TRADING PROGRAM IN SPITE OF TRADING LOSSES ARE MATERIAL POINTS WHICH CAN ALSO ADVERSELY AFFECT ACTUAL TRADING RESULTS. THERE ARE NUMEROUS OTHER FACTORS RELATED TO THE MARKETS IN GENERAL OR TO THE IMPLEMENTATION OF ANY SPECIFIC TRADING PROGRAM WHICH CANNOT BE FULLY ACCOUNTED FOR IN THE PREPARATION OF HYPOTHETICAL PERFORMANCE RESULTS AND ALL OF WHICH CAN ADVERSELY AFFECT ACTUAL TRADING RESULTS.”

Due to the proprietary nature of our investment service and the mentoring educational aspects we are not able to offer refunds.